Based in Western Australia, Axis Mining Technology serves the mining industry with specialised geospatial tools and instruments

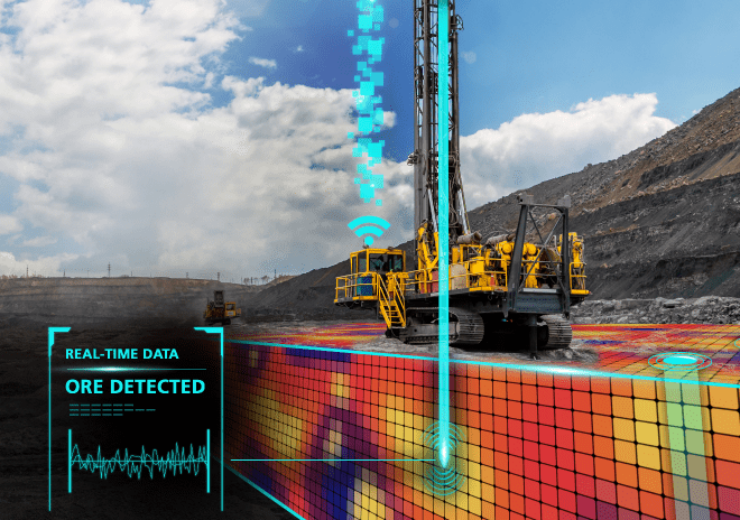

Digital orebody intelligence provider Axis Mining to be acquired by Orica. (Credit: Orica Limited)

Australia-based explosives supplier Orica has agreed to acquire Axis Mining Technology, a digital orebody intelligence business, in a deal worth up to A$350m ($243m).

The consideration comprises A$260m ($180m) in cash as an upfront payment followed by a deferred earn-out payment up to A$90m ($63m).

Based in Western Australia, Axis Mining Technology caters to the mining industry with specialised geospatial tools and instruments.

The company is expected to complement Orica’s Digital Solutions platform and help the latter become an integrated, end-to-end, mine to mill solutions provider.

Axis Mining Technology’s geospatial technology is said to expedite Orica’s capabilities in supporting new mineral discoveries needed for decarbonisation. These include new mineral discoveries that are located increasingly at greater depths and require more precise geophysics.

Furthermore, the gold and copper exposure of Axis Mining Technology is expected to accelerate the broader commodity mix goals of Orica.

Orica managing director and CEO Sanjeev Gandhi said: “This strategic acquisition further strengthens our existing Digital Solutions vertical and expands our Orebody Intelligence portfolio upstream.

“Orica’s purpose is to sustainably mobilise the earth’s resources and achieving this starts with a better understanding of the orebody at the start of the mining value chain.

“I believe that Axis’ differentiated geospatial tools and instruments, combined with our existing suite of digital solutions will provide compelling orebody intelligence to customers and support the delivery of the industry’s first end-to-end solutions platform, from mine to mill.”

Axis Mining Technology designs, manufactures, and distributes specialised navigation instrumentation and data and drilling solutions.

Its products are made and assembled at its facilities in the UK and Australia. They are distributed to more than 30 countries, with earnings mainly coming via recurring product rental.

The deal, which is subject to the meeting of preceding conditions, is expected to close by October 2022.

Orica also announced that it will raise a capital of A$650m ($451m) via fully underwritten institutional placement.