In its preliminary investigation, the EC concluded that the parties are close competitors for the delivery of broadband IFC services to commercial airlines in the European Economic Area (EEA) or global markets

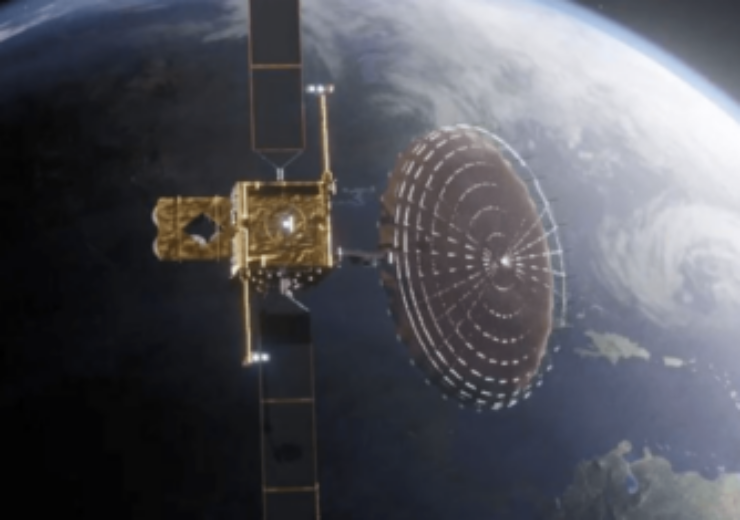

EC to undertake in-depth probe into Viasat, Inmarsat $7.3bn deal. (Credit: Inmarsat Global Limited)

The European Commission (EC) has launched an in-depth investigation (phase 2) into the previously announced Viasat’s $7.3bn acquisition of British mobile satellite communications services provider Inmarsat.

The body initiated the probe due to concerns that the proposed deal would enable Viasat to stifle competition in the market for the supply of broadband in-flight connectivity (IFC) services to commercial airlines.

The move comes after the commission’s preliminary investigation concluded that the parties are close competitors for the delivery of broadband IFC services to commercial airlines in the European Economic Area (EEA) or global markets. The also parties compete head-to-head in tenders for IFC contracts.

According to the EC, there are currently few other providers, and the market entry is difficult with obstacles including regulatory and technological ones.

The Commission has also stated that it will examine if the new players in the market are likely to exert sufficient competitive pressure on the merged entity in the near future.

EC Executive Vice-President Margrethe Vestager, in charge of competition policy, said: “In-flight connectivity is a nascent and growing market in Europe. Viasat and Inmarsat are two leading suppliers of connectivity services during flights and they compete head to head to serve European airlines.

“With our in-depth investigation, we aim to ensure that the acquisition of Inmarsat by Viasat does not lead to higher prices and lesser quality for in-flight connectivity services on flights in Europe.”

The Commission has set itself a deadline of 29 June 2023 to take a decision on the proposed acquisition. Viasat and Inmarsat announced their stock cum cash deal in November 2021.

As per the terms of the deal, Inmarsat’s shareholders will get $850m in cash and nearly 46.36 million newly issued shares of Viasat valued at $3.1bn.