Japanese tech company DexisChain has launched a public token for its blockchain-based investment platform focused on real estate market predictions - closing the gap between property, technology and innovation

DexisChain launches blockchain platform focusing on real estate

Predicting the real estate market will be made easier with blockchain after Japanese firm DexisChain launched a platform that uses the technology for investors.

The software, which is aimed at investors with varying levels of experience and liquidity, can quickly source, analyse and act upon high-quality real estate market data.

DexisChain believes it can “completely reshape” the industry through its blockchain platform, called the DexisChain Protocol Token (DCPT).

It works as a digital database containing records and financial transactions that can be simultaneously used and shared within a decentralised publicly accessible network.

DexisChain director Nobuo Takaki said: “We believe that we will become the key service for the real estate market.

“Real estate is low liquidity because of regulatory barriers so we thought that using tokens will solve this problem.”

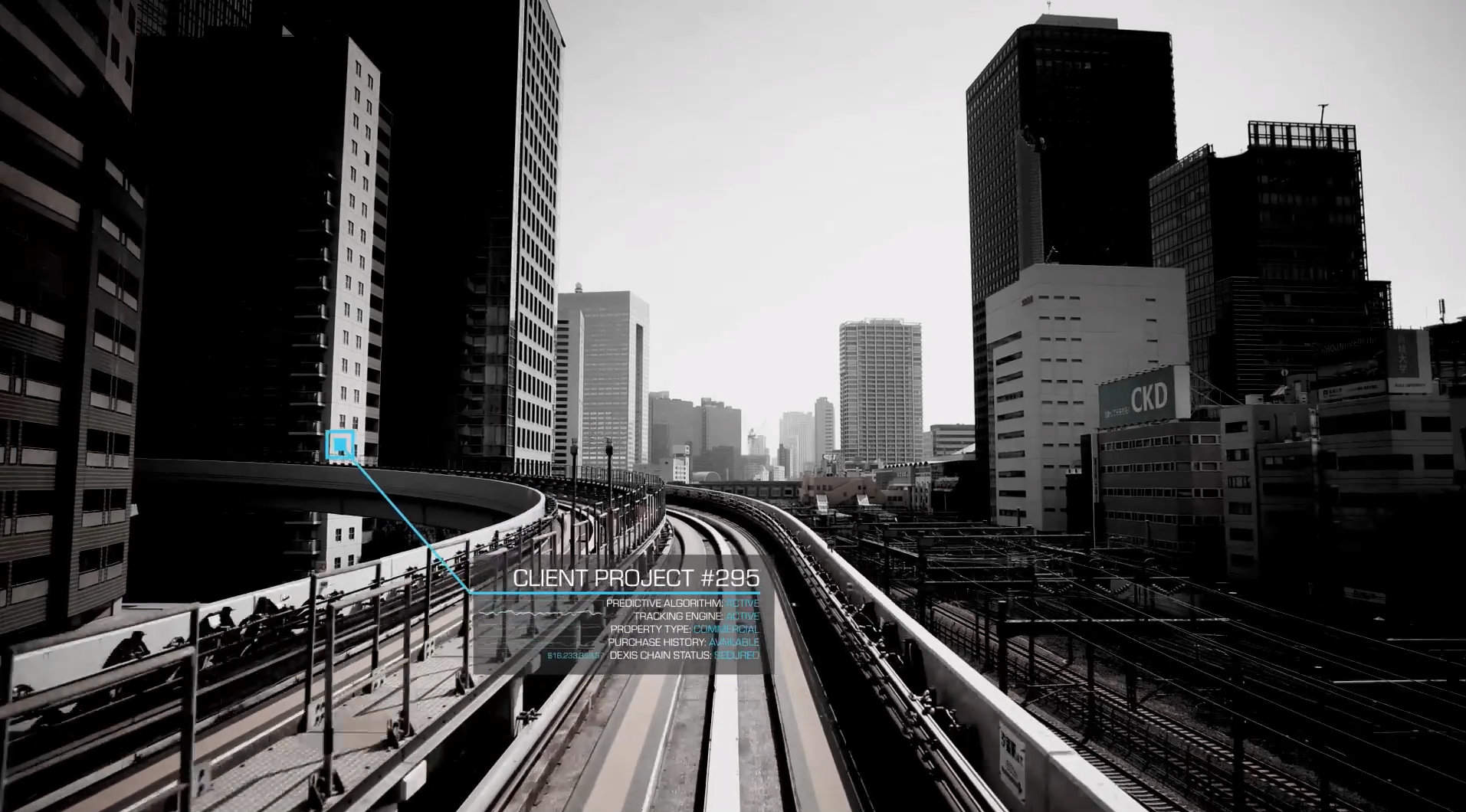

DexisChain could change the way people invest in the real estate market

The DCPT platform, which launches on 6 August, could change the way people invest in the real estate market.

By using blockchain, it allows investors to look into a global pool of liquidity.

It also gives those looking to make an offer some level of certainty over the sensitive nature of betting on prediction markets.

It has already sold $7m (£5.34m) of DCPT privately through a token sale, with a total of $2bn (£1.53bn) DCPT available to be issued moving forward with no inflation or more token creation required.

The token sale will have a hard cap of 51,566 (ETH) Ethereum.

DexisChain hopes to thrive in a $1.7tn market

By using bloackchain, DexisChain is hoping to flourish in a market that now has a global market capitalisation of approximately $1.7tn (£1.3tn).

Having a new class of liquid real estate assets, it hopes this will stop restrictive financial barriers that block direct investments.

This will allow anyone to tokenise property on an open market, thereby opening real estate to a new world of investors.

DexisChain says eeal estate investing regulations are prohibitive and limit the potential pool of investors, while investment size restrictions price out the vast majority of interested investors.

It seeks to resolve this “worldwide information inequality” though the application of blockchain-based predictive markets, coupled with a machine learning and modelling layer to generate affordable, reliable and actionable investment data for the real estate space at all levels of investing experience.

DexiChain has plans to launch beta service in 2019

The company, which currently only operates in Japan, has plans to grow its markets to India and Africa.

It will also eventually feature all real estate investing products, such as real estate ETFs (exchange-traded funds), mutual funds and individual company stocks, as well as other more granular real estate data.

It will be used by investors to peruse through and act upon the real estate market data available to them.

Mr Takaki said: “We will launch beta service of Dexis in mid-2019 and after gaining many users, we will launch the official platform in 2020.”

This is not the first real estate company to use blockchain.

SwissRealCoin, the Swiss-based real estate company launched the first asset-backed token real estate investment platform in March 2018.

Similar to DexisChain, its aim was to provide better access to real estate investments by means of crowdfunding real estate acquisition.