The move from e-commerce to m-commerce is well underway - and it means retailers need to take note of the payment trends for 2019, says Worldpay's Motie Bring

First there was the online shopping revolution, and very soon there’ll be a mobile shopping tide sweeping up all before it – meaning retailers would be wise to take note of the payment trends for 2019.

Mobile commerce – or m-commerce – is expected to overtake desktop as the preferred method for online shopping by 2023, according to US payment processing company Worldpay.

Consumers expect their shopping experience to be the same across all touchpoints – whether digital or real world, and retailers need to understand their customers’ purchasing preferences to set themselves up for success.

Motie Bring, the UK general manager of global e-commerce at Worldpay, gives his tips on how retailers can cope with the latest payment trends.

What do shoppers expect from retailers when it comes to paying?

Today’s digitally-driven consumers are intolerant of obstacles that hinder their frictionless shopping experience, both online and in-store.

UK consumer spend has evolved over the past few years due to different socio-economic factors, with shoppers now spending more on experiences over products.

They also expect brands to engage with them on a regular basis by creating experiences and content that will cement their trust.

If retailers want to stay ahead of the curve, they will need to work harder to earn consumer spend through exclusive offers, loyalty schemes and discounts.

They will also need to ensure the customer journey is as seamless as possible right from navigation through mobile apps, quick checkout and a secure payment process.

Alongside changes in consumer behaviour, 2019 will also bring significant regulatory changes as a result of the new Payments Services Directive 2.0 (PSD2) and the implementation of strong customer authentication (SCA) measures later in the year for online transactions.

While this will lead to several opportunities for retailers, there will also be a few challenges that will need to be overcome.

Anyone accepting payments from their customers will need to bear this – and the trends captured below – in mind if they’re looking to deliver a seamless purchasing experience for their customers, irrespective of how they choose to pay.

Loyalty rewards could be linked to mobile payment trends in 2019

Most brands understand the value of having a loyalty scheme. The challenge is getting customers to sign up and use it.

Whether it is the registration process, or simply forgetting to use the loyalty card, there’s a number of ways loyalty schemes don’t reach their full potential for both retailers and consumers alike.

By linking rewards programmes to payments, retailers have the opportunity to integrate both and enhance the customer journey.

Retailers should use 2019 as an opportunity to work with their payment partners on how to optimise the payment process to create better user experiences, predictable revenue, and drive customer loyalty.

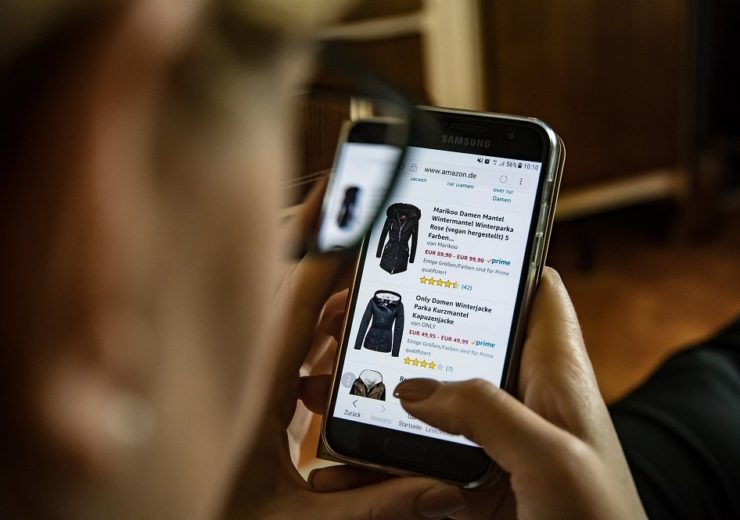

Rise of m-commerce is at the centre of payment trends in 2019

It is estimated that by 2021 smartphones will outnumber humans.

The smartphone has become the heart of the retail experience – from online shopping and payments to in-store research, or even replacing payment methods of old.

Mobile commerce now leads as the fastest-growing channel globally, with the UK being the third largest m-commerce market.

This year, m-commerce in the UK is set to grow by 19%. This will be fuelled by the rapid rise of e-wallets in the country, projected to increase by 15% to £47m in 2019.

Additionally, the latest mobile innovations including biometric security, such as voice recognition and facial scanning are helping to make payments more seamless and secure – prompting consumers to ditch desktops in favour of their smartphone or tablet.

Retailers will have to invest more to create a mobile-first shopping experience.

With the continuing growth of m-commerce, the enhancement of mobile channels needs to be at the centre of retailers’ strategy.

The maturing of alternative payment methods

The exponential rise of alternative payment methods is not limited to e-wallets.

Bank transfers are also set to increase by 34% this year, and will be worth an estimated £21m by the end of 2019.

This is in part due to the regulatory changes around PSD2.

The advent of open banking will offer technology companies and traditional institutions more opportunities to provide alternative ways to pay outside of mainstream card payments.

While there’s still a way to go before we see broad consumer adoption, retailers should have an eye on future changes in consumer payment habits when building their strategies today.

Savvy retailers will be experimenting with new payment models in 2019 as they look to future-proof and optimise their retail strategy.

The focus may be on building consumer loyalty through the payment options they are offered throughout the customer journey.

For example, “try before you buy” rather than “buy now, pay later” could become an increasingly attractive payments model for both retailers and consumers.

What this means is the buyer gets their item straight away, and if they like it, they pay for it within a specified time. If not, they return it at no cost.

For retailers, this reduces shopping cart abandonment, and for consumers it delivers a seamless and quicker shopping experience while enhancing their trust in the brand.

We could also see subscription models moving beyond digital media as they become more commonplace within other retail sectors, such as fashion and clothing, food and drink, personal health and beauty.

For the consumer, the main benefit is around cost saving, but it also adds another level of convenience, removing the need to re-order.

Retailers can use this as an opportunity to surprise and delight by enhancing the service they provide customers and offering rewards for loyalty.

New mobile apps will integrate shopping and payment as one of the 2019 trends

In 2019, it will be important for UK retailers to invest in their own apps, building a seamless shopping and checkout experience across every device, while supporting the most popular payment methods like PayPal and Visa Checkout.

Simplifying the online payment experience and making this as quick as possible will best serve what is an increasingly convenience-focused market.

The role of emerging technology in payment trends for 2019

Satisfying consumer needs instantly, and at scale, will continue to be of paramount importance for retailers.

We may start to see emerging technologies like robots, as well as increased automation playing a bigger role in how retailers serve their customers.

With the high street currently battling various challenges, 2019 could be a make-it-or-break-it year for many retailers.

In order to ensure their own survival, the focus on customer experience will be paramount.

Overlooking the importance of payments as final step in the customer journey would be a mistake.

The retailers who will triumph in the shifting world of customer preferences and the coming m-commerce revolution will be those who embrace change.