The majority of surgeries have been given less priority due to Covid-19, while other medical device markets have come to the fore in recent months

Numerous medical device markets have been impacted directly by Covid-19 over the course of 2020 (Credit: Pixabay)

Industries, markets and businesses the world over have been turned upside down by Covid-19, and this impact has been especially profound within the medical device sector.

However, while the impact of the pandemic has been overwhelmingly negative in many areas, the medtech industry has experienced both ups and downs throughout the crisis.

Massively increased demand for critical pieces of equipment such as PPE (personal protective equipment), ventilators and testing kits — along with subsequent shortages of these devices — has seen firms do everything they can to keep pace with the ever-growing needs of healthcare providers.

Those within the industry have had to uproot many of their usual supply chains as other sectors grind to a halt, while lockdown protocols across the globe have changed how the majority of companies function on a day-to-day basis.

But with attempts to tackle Covid-19 requiring the combined efforts of everyone in the wider healthcare community, several non-essential areas and device markets have had to take a backseat — at least until the worst of the crisis has passed.

We take a closer look at six of the most prominent market trends the coronavirus pandemic has triggered so far.

Covid-19 impacts on medical device markets

Aesthetic procedures

Many aesthetic procedures — the vast majority of which are cosmetic surgeries like breast implantation, lipoplasty and non-essential dental procedures — have been delayed due to the Covid-19 crisis.

To free-up limited space for people being treated for the virus, hospitals have postponed, or cancelled, many elective operations — especially those deemed to be non-essential or non-urgent.

NHS hospitals in the UK have suspended all non-urgent aesthetic surgeries for at least three months in an attempt to free-up resources.

Similarly, the US federal government and the American College of Surgeons have advised the country’s hospitals and clinics to delay aesthetic procedures — although individual health systems maintain the right to make decisions based on the unique needs of their communities.

Analytics firm GlobalData estimated in March that between 15% and 30% of all elective surgeries could be cancelled.

The analytics firm now anticipates this has risen further, indicating last week that anywhere from 70% to 100% of all aesthetic procedures performed in the US could have been delayed, postponed or cancelled due to Covid-19.

Eric Chapman, medical devices analyst at GlobalData, says: “The market for aesthetic injectables, implants, bariatric surgery and cosmetic procedures will be especially vulnerable since these procedures are non-urgent, and can be postponed without majorly affecting quality of life.

“With respect to breast implant procedures, GlobalData anticipates that surgeries will begin to resume in June and will return to pre-coronavirus rates by Q4 2020, with total numbers returning to pre-coronavirus levels by Q1 2022.

“The recovery of procedures will start when new Covid-19 admissions have declined to low levels below 1.5 new cases per 100,000 of the population, and surgeries related to cancer or acute pain will be implemented first.”

Domestic manufacturing of medical devices

As previously mentioned, disruption caused by Covid-19 to international supply chains has led to high-profile shortages of critical medical devices.

While many countries have attempted to ease shortages by importing equipment, GlobalData says domestic manufacturing of many devices has also increased during the crisis.

Tina Deng, senior medical devices analyst at GlobalData, believes the “crucial reality” is that the demand for medical devices has proven to be much higher than what domestic manufacturers can deliver.

This is because many supply chains have been established abroad for several years and are highly dependent on imports.

Despite this, Deng says: “Ramping up domestic production capacity of medical supplies is the major focus for many countries as Covid-19 spreads.

“From a risk-analysis perspective, relying on imports of essential medical devices is a serious threat to public health security.

“GlobalData expects a noticeable trend towards moving from a dispersed supply chain back in favour of domestic production for key medical devices.

“Domestic manufacturing of essential medical devices can not only overcome trade barriers, but also ensure product quality and market stability.”

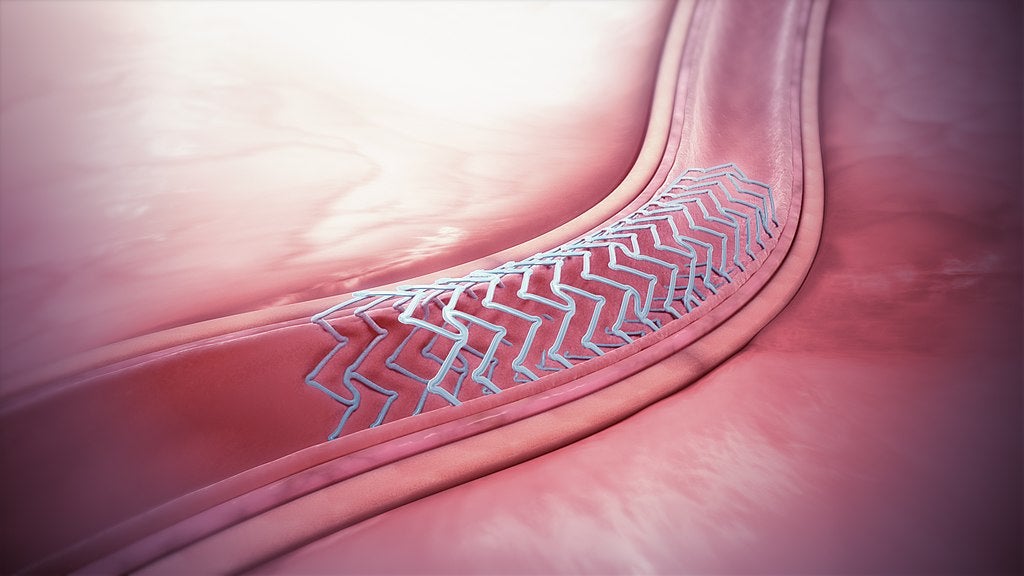

Aortic and coronary stent grafts

Aortic stent grafts involve inserting a small tube called a stent into the aorta of a patient to shrink, and ultimately treat, an aneurysm.

Similarly, in percutaneous coronary intervention (PCI) procedures, a stent is placed inside a patient’s coronary artery to effectively hold the blood vessel open.

By preventing blood flow to the heart from becoming restricted, this is used to treat coronary heart disease (CHD).

Aortic and coronary stent grafts alike are minimally invasive because the stent is inserted into the patient’s body using a catheter device, meaning open surgery is not required.

The markets for both aortic and coronary stents were expected to grow significantly over the next decade, with a compound annual growth rate (CAGR) of 4.5% and 3.4% respectively, according to GlobalData.

However, many non-urgent varieties of these procedures are now being postponed or cancelled due to the Covid-19 pandemic, decreasing revenues in these markets — especially in severely-hit countries such as the US and Italy.

Dr Azadeh Laffafian, medical devices analyst at GlobalData, says: “Non-urgent aortic aneurysm procedures are expected to be deferred at this time.

“Additionally, it is likely that the rates of diagnosis for asymptomatic and mildly symptomatic aortic aneurysms will be lower during the pandemic as check-ups and diagnostics are reduced, and patients are wary of visiting physicians due to fear of Covid-19 exposure.

“Overall, the Covid-19 pandemic is expected to have minimal impact on lifesaving cardiovascular procedures. For example, some PCI procedures are considered urgent in treating acute myocardial infarction or a heart attack.

“However, a proportion of PCI procedures are performed on patients who are not experiencing an acute medical crisis, and these non-emergency cases are expected to be avoided or deferred during the pandemic.

“One advantage that stent graft markets have over open surgery during the Covid-19 crisis is their minimally invasive nature and the fact that patients need to spend a shorter duration of time recovering in the hospital.

“Therefore, it is expected that endovascular approaches will be preferred over open surgery to free-up beds for Covid-19 patients and reduce the amount of time non-coronavirus patients are potentially exposed to the virus in hospitals.”

EU medical device regulation postponed

On 17 April, the European Union voted to postpone its Medical Devices Regulation (MDR) — a new set of regulations for medtech firms to adhere to — by one year.

It had been set to come into effect on 26 May 2020, replacing the existing Medical Device Directive (MDD), but will now be scheduled for the same date next year.

This decision was taken to allow the European medtech industry to cope with the impact of the Covid-19 crisis.

GlobalData estimates that the MDR would have disrupted the approval process for many new medical innovations — as well as the re-certification of existing devices — but the postponement of these regulations is likely to have taken the pressure off many companies within the industry.

Aliyah Farouk, medical devices analyst at GlobalData, says: “The new MDR required companies to undertake lengthy technical preparations needed for the market approval of their products.

“Under the current MDD regulations, the in-house reuse of single-use devices is permitted through design modifications, and cleaning and decontamination.

“However, the MDR states single-use devices are to be professionally remanufactured.

“With the Covid-19 pandemic causing shortages in PPE, such as facemasks, many institutions have had to reuse equipment in order to meet the demand.

“The postponement, therefore, takes into account the challenges of the coronavirus pandemic and the need for increased availability of vital medical devices across Europe.

“As the outbreak has heightened demands for certain devices, postponing the MDR ensures market disruptions for critical devices is limited.”

In vitro diagnostic products

With the Covid-19 pandemic beginning to take hold of populations across the world in February and March, there was an increasing global demand for diagnostic testing kits as healthcare authorities attempted to measure and track the true spread of the virus.

A host of companies from the biotech, pharma and medical devices industries began to urgently develop coronavirus tests to plug shortages of these critical pieces of equipment.

The need to test for the virus on demand, therefore, led to a shift in the pipeline of in vitro diagnostic (IVD) products, with a greater number rapid, point-of-care devices entering into development.

The most common type of these testing kits are PCR (polymerase chain reaction)-based assay tests, which involve taking a swab sample from a patient’s nose or mouth, and can detect the genetic code for SARS-CoV-2 — the virus that causes Covid-19 — in people who are currently infected.

Several giants in the healthcare sector, including Thermo Fisher Scientific, Abbott Laboratories and Roche Diagnostics, previously received emergency use authorisation (EUA) from the US Food and Drug Administration (FDA) for their diagnostic tests and have since ramped-up production to help alleviate testing shortages.

In April, Alison Casey, medical devices analyst at GlobalData, said there were close to 100 other IVD products for Covid-19 in the medtech development pipeline — with over half of these being point-of-care devices.

This indicated that manufacturers were “anticipating substantial future demand for rapid diagnostic testing”, Casey added.

This has proven true over the past couple of months, as the US and the UK have conducted millions of diagnostic tests in total, and several countries have managed to curb the spread of the virus by deploying widespread testing from the outset — most notably Germany and South Korea.

Robotics and automation in India

According to GlobalData, the Covid-19 crisis has led to workforce shortages in India — impacting both the supply and the demand for medical devices in the country.

This has presented manufacturers with the opportunity to integrate more robotics and automation into their production processes, ensuring less output interruption at a time when workforces are smaller, and lockdown protocols mean fewer people can work in the same space.

GlobalData also believes the Indian government should encourage or incentivise its domestic medtech firms to integrate these technologies into manufacturing.

India faced shortages of PPE and ventilators when it was first hit by Covid-19, with production of these devices being almost negligible after a large number of migrant workers returned to their homes in rural areas of the country.

And while India has increased production to become “one of the largest producers of these devices” anywhere in the world over the past few months, GlobalData estimates that, without robotics and automation, the medical devices manufacturing sector may struggle once full-scale operations restart.

Rohit Anand, medical devices analyst at GlobalData, says: “Companies from other sectors started manufacturing PPE and ventilators as they could sense the opportunity.

“This means that the existing medical device manufacturers need to revisit their strategy in the long term, as the new entrants may need workforces skilled in manufacturing devices.

“Domestic manufacturers may continue to allow office staff to work from home but this policy will not work with staff employed in factories managing production, and many workers may not want to go back to work immediately – unless they feel it is safe to return – which could lead to a crisis.

“Companies may gradually increase the use of robotics and automation, but it could take time for all the manufacturers to adopt these technologies.

“In addition, it will also allow for a quicker and more efficient ramp-up of production of essential medical devices during future healthcare emergencies.”