As RBS makes a public commitment to combating climate change, it joins global banks like HSBC, Bank of America and Deutsche Bank in moving away from fossil fuels and providing financial backing to more sustainable projects

The Royal Bank of Scotland (RBS) has changed its lending policy to exclude firms profiting from coal and will no longer fund Arctic oil projects, it was announced on Monday.

It marks the latest public move by a bank to combat climate change in what has become a growing trend over the last decade, with HSBC, Deutsche Bank and others overtly committing to sustainable and environmental causes.

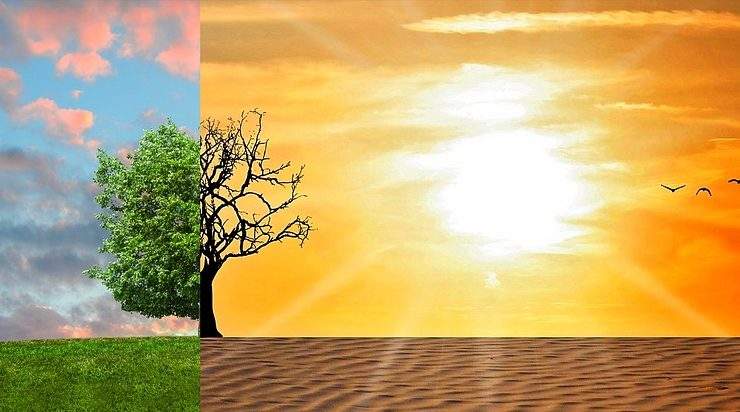

With the first month of 2018 being the warmest January in 138 years of modern record-keeping, it’s clear to see why they’re taking action.

However, multiple banks have been criticised for only dipping their toe into the issue, including RBS, which faced criticism from Scottish campaigners who said not enough is being done.

The Bank of England (BoE) was similarly lambasted in a recent report by campaign and research group Positive Money, which said it must use its existing powers more effectively to promote a low-carbon economy.

Despite this, steps are being taken in the right direction. Here’s what several of the world’s top banks are doing to combat climate change.

RBS

In March, RBS said it would commit £10bn to the sustainable energy sector between 2018 and 2020, and that 80% of its energy project financing went to renewables last year.

Its latest policy change intends to augment this by prohibiting project-specific finance to coal-fired power stations and thermal coal mines, as well as projects in Arctic oil, oil sands, and unsustainable vegetation clearance projects.

Further to this, RBS will not provide finance to mining companies generating more than 40% of their revenue from thermal coal and power companies generating more than 40% of their electricity from coal – both figures down from 65%.

Kirsty Britz, director of sustainable banking at RBS said: “The RBS of 2018 is a very different to the bank we were a few years ago.

“If we’re going to support our customers in the long run, then it means addressing the challenge of climate change and the risks and opportunities it presents.

“We want to help build a cleaner, more sustainable economy for the future, and these policy changes form part of our broader approach to this major issue.”

Deutsche Bank

Also in 2017, Deutsche Bank created a sustainability council comprising leaders across business and infrastructure to advise its management board on how to strengthen and develop its sustainability strategy.

It has a dedicated eco-performance management office to track, analyse and report its emissions data, and set a 2017 target of reducing electricity consumption by 1% in 2017, which it bettered with 1.7% in addition to slashing paper usage by 7%.

The bank also provides strategic consulting on multiple projects to promote private investment in clean energy and technologies using specialist research teams and active co-operation with political decision-makers.

BNP Paribas

In order to conform to the UN’s sustainable development goals, BNP Paribas made carbon neutrality the foundation of its policy on environmental responsibility in April.

Prior to this, it made three major changes, which first involved the reduction of CO2 emissions through establishing an active policy of energy efficiency at its buildings and data centres, which produce 73.5% of its emissions.

This reduced the bank’s energy consumption to an average of 195 kilowatt-hours per square metres (kWh/m2) in 2017, down from 201 kWh/m2 the year previous.

Secondly, BNP Paribas made a commitment to using low-carbon electricity solutions for all its needs, and last year increased the renewable energy usage in its buildings to 26.2% of all electricity consumed.

Lastly, the bank has made several partnerships specifically geared towards counteracting CO2 emissions.

These include teaming up with NGO Wildlife Works – which runs a program to preserve and restore 500,000 hectares of forest in Kenya – to counteract 455,000 tonnes of CO2 last year, and supporting the GoodPlanet project, which BNP Paribas estimates will counteract an average of 15% of emissions annually over the next decade.

Bank of America

Since 2007, the Bank of America has poured more than $87bn (£65bn) into financing low-carbon and sustainable business activities and plans to increase this to $125bn (£94bn) by 2025.

Last year, it put $17bn (£12.8bn) towards this end, including $6.2bn (£4.6bn) to raise equity and debt capital, and provide advisory services to support its clients’ low-carbon business.

The fund also included $6.6bn (£5bn) for municipal sustainability projects, $2.9bn (£2.18) for equipment and tax equity financing for renewable energy and efficiency projects, and $342m (£257) to provide loans for hybrid and electric vehicle purchases for consumers.

HSBC

In November last year, HSBC pledged to provide $100bn (£75bn) in sustainable financing and investment by 2025 as part of a five-point plan to tackle climate change and support sustainable growth.

The other four elements included pledges to source 100% of its electricity from renewable energy by 2030, to discount financing of new coal-fired power plants in developing markets, to adopt the Financial Stability Board’s Task Force on Climate-related Financial Disclosures recommendations, and to lead and shape the debate about sustainable finance investment.

Group chief executive Stuart Gulliver said: “For more than a decade, HSBC has helped clients break new ground in the green bond markets in Europe and Asia, and to finance some of the biggest climate-friendly infrastructure projects in the world.

“The $100bn commitment that we are announcing today acknowledges the scale of the challenge in making a transition to a low-carbon future.

“We are committed to being a leading global partner to the public and private sectors as they make that transition.”